By Richard Charles,

2014 Las Vegas District 1

Possible Congressional Candidate

Possible Congressional Candidate

An informed electorate is a happy, powerful and wise electorate.

With Budget debt ceiling limit and IRS scandals in the forefront of news now, more and more people are looking for a better way to fund and improve government.

It is instructive for voters to see how incumbent politicians legislated in this regard, in particular District 1 Las Vegas.

The 2013 US Budget consists of $2.9 trillion in taxes and $3.8 T in spending.

It is -$900 Billion dollars in deficit, red, short, underwater, upside down:

If we Americans ran our financial affairs that way, we would not only be homeless, living in our parents’ basement on foodstamps, unemployment and welfare, but out

of work, bankrupt, impoverished:

"He has erected a multitude of New Offices, and sent hither swarms of Officers to harass our people and eat out their substance."

So Thomas Jefferson wrote in our Declaration of Independence:

"He has erected a multitude of New Offices, and sent hither swarms of Officers to harass our people and eat out their substance."

So Thomas Jefferson wrote in our Declaration of Independence:

Or we might be getting dunned by the California Franchise Tax Board (CAFTB) claiming, despite Nevada Residency since 1976, there is no confidentiality, due process or statute of limitations on bogus claims dating back more than 15 years.

(CA FTB lost a $500 Million tax case for fraud, misconduct, negligence and torts that was appealed to the Nevada and US Supreme Courts:

The State of California claimed $15.7 billion budget deficits were reason to raise income taxes to the highest state income taxes in the land.

Politicised Courts and Representatives ignored the will of the people passing Propositions into Law and instigated government mandated taxpayer funding for free education, healthcare, prison, welfare and illegal alien votes to stay in power, while piling up debts that increased the cost of living and led to California exodus by billionaires and little people alike.

Politicised Courts and Representatives ignored the will of the people passing Propositions into Law and instigated government mandated taxpayer funding for free education, healthcare, prison, welfare and illegal alien votes to stay in power, while piling up debts that increased the cost of living and led to California exodus by billionaires and little people alike.

Never mind the $577 Billion in Comprehensive Annual Financial Report (CAFR) reserves CA kept secret from taxpayers:

Washington, DC also has hidden reserves. DC denizens mismanaged Federal budget finances to create hidden inflation, rig markets and raise taxes on taxpayers without real representation.

The result was even more Americans out of work, homeless or bankrupt.

At least 82 million Americans are disabled, retired or unemployed, partly illustrating Aesop’s fable about the productive Ant and government Grasshopper, a theme picked up by artists, Disney, DreamWorks, Pixar and others over the generations with Antz, A Bug’s Life et al:

Of $2.9 trillion in 2013 budgeted Federal taxes, less than half a percent of tax revenues come from estate and gift taxes raised up to 45% by the current incumbent majority.

1% of Federal Tax Revenues come from custom duties/trade tariffs.

2% come from Federal Reserve usury profits lending to the Treasury.

3% come from excise taxes on alcohol, gasoline, tobacco etc.

12% come from corporate taxes.

33% come from the robbed Medicare, payroll and Social security tax "lockbox Trust".

47% come from income taxes.

Thus the lion’s share of US government tax revenues come from individuals or families, rather than mega-corporations, foundations, unions whose lobbyists write the laws so they pay little or no taxes at all.

So much for "middle class tax cuts" that were actually increases and the politics of envy and poverty.

Under Obama and the Democrat majority in the Senate, spending sequesters are 2.4% of the budget.

Tax increases are 6.2% of the budget:

Tax increases are 6.2% of the budget:

Tax increases are almost three times the claimed dollars cut in spending.

They are even more after deducting the $60 Billion Hurricane Sandy Disaster Relief bills passed by the Las Vegas District 1 Freshman and others who refused to cut government spending by an equal amount as long promised with revenue neutrality:

They are even more after deducting the $60 Billion Hurricane Sandy Disaster Relief bills passed by the Las Vegas District 1 Freshman and others who refused to cut government spending by an equal amount as long promised with revenue neutrality:

The original promises of incumbent politicians were five dollars in spending cuts for every dollar in tax hikes.

Then they were a dollar cut for every dollar tax hike.

Most recently they were a dollar cut for every three dollars in tax hikes.

Under Obamacare, this gets more lopsided.

Then they were a dollar cut for every dollar tax hike.

Most recently they were a dollar cut for every three dollars in tax hikes.

Under Obamacare, this gets more lopsided.

It might appear a majority of incumbent political employees running or working for Federal government, paid by taxpayers by law for just representation, are financial illiterates who didn’t pay their taxes, yet expected others to pay their taxes. Do as I say, not as I do.

This included the resigned Treasury Secretary who claimed trouble with TurboTax was the reason he spent his International Monetary Fund W-2 tax stipend funds instead of paying them to the IRS, until he was found out during vetting, which still did not stop his appointment supervising the IRS:

It also includes 100,000 Federal Employees who owe more than a billion dollars in unpaid taxes.

Members of Congress tried to fix this by passing a law to fire seriously tax-delinquent Federal Employees, to make room for more productive employees:

The Freshman incumbent US Representative in Las Vegas District 1 and a majority of incumbent Representatives offered no relief to taxpayers when they voted against the Federal Employee Tax Accountability Act of 2013:

Our American Revolution established the principle of ‘No taxation without representation.’

Yet that is what we suffer.

Yet that is what we suffer.

237 years later, nowhere is this more clear than with Obama Care, the largest hidden tax hike in history.

The USA spends more than 15% of its economy on healthcare, which increases as government takes over.

Of 17 high-income countries studied by the National Institutes of Health in 2013, the United States was at or near the bottom in infant mortality, heart and lung disease, sexually transmitted infections, adolescent pregnancies, injuries, homicides, and rates of disability.

Together, such issues placed the U.S. at the bottom of the list for life expectancy.

On average, a U.S. male can be expected to live almost four fewer years than those in the top-ranked country:

Like Education and Energy, this suggests high government prices are not to be confused with actual quality or results.

In 2010, citizen constituent calls opposed Obamacare more than 100 to 1 across the United States.

They were ignored with a giant put-down of the US Citizen by a majority of elected representatives who voted for 0Care.

This led to the House changing hands in 2012, retiring the Freshman Incumbent US Rep in Las Vegas.

A majority of Representatives and Senators in Congress passed the Obamacare promise.

This led to the House changing hands in 2012, retiring the Freshman Incumbent US Rep in Las Vegas.

A majority of Representatives and Senators in Congress passed the Obamacare promise.

The incumbent political majority claimed this was the most transparent administration in history.

Yet 0Care’s 2801 pages written by special interest paid lobbyists were unavailable before the vote for reading or review by American citizens footing the bill or members of Congress.

In fact, former Speaker of the House, Nancy Pelosi, boldly declared Congress would “have to pass the Affordable Healthcare Act to see what is in it.”:

In fact, former Speaker of the House, Nancy Pelosi, boldly declared Congress would “have to pass the Affordable Healthcare Act to see what is in it.”:

0Care was described as “not a tax” and "not a spending hike" by the President, House Speaker, Congressional majority and sponsors.

Somehow more people were to gain health insurance while spending less, the free lunch theory that ruined America's prosperity.

Somehow more people were to gain health insurance while spending less, the free lunch theory that ruined America's prosperity.

The Las Vegas Freshman incumbent and a slim majority voted for "0Care, not a tax, not a spending hike":

In fact, the Supreme Court ruled 0Care was a tax:

0Care was in fact the biggest tax and spending hike in history, some $1.8 Trillion so far and rising:

0Care’s 2801 unread pages were largely written by healthcare industry lobbyists to increase corporate profits.

Unions exempted themselves from 0Care taxes with waivers, Congress repeatedly tried to exempt themselves, but was caught with its hand in the cookie jar:

Unions exempted themselves from 0Care taxes with waivers, Congress repeatedly tried to exempt themselves, but was caught with its hand in the cookie jar:

0Care includes over 20 new taxes of $2085 per family and up, many new IRS agents to enforce it, federal subsidies up to 400% of the poverty level, guaranteed insurance policy issue without pre-existing conditions, health insurance exchanges, with higher health insurance premiums for all, individual mandates with 0Care fines, 300% penalties and taxes deducted from income tax refunds:

http://www.politifact.com/virginia/statements/2010/dec/20/bob-marshall/del-bob-marshall-says-violators-obama-health-care-/

Of course 0Care will cost more, deliver and save less than promised. That was apparent common sense everywhere but DC:

Of course 0Care will cost more, deliver and save less than promised. That was apparent common sense everywhere but DC:

Here are politicians denying the sky is blue:

As George Washington said:

Government is not reason, it is not eloquence, it is force; like fire, a troublesome servant and a fearful master. Never for a moment should it be left to irresponsible action.

Despite emotional pleas for the uninsured, 0Care in fact leaves 26 million Americans uninsured.

0Care cut Medicare for Seniors by at least $716 Billion the next ten years.

0Care created mandatory healthcare premiums up to 9.5% of our gross incomes, leading many people to drop health insurance coverage, work less than full time or become scofflaws until they are caught.

0Care will cost $1.8 Trillion the next ten years (not saving money as originally claimed).

0Care added $17 Trillion in unfunded mandates to the Federal Budget so far:

Proof 0Care was written by lobbyists for the healthcare industry was suggested by 0Care stock performance since 0Care was passed:

Market up +64%: http://stockcharts.com/freecharts/gallery.html?s=%24SPX

Insurance up +73%: http://stockcharts.com/freecharts/gallery.html?$INSR

Health Care Products up +86%: http://stockcharts.com/freecharts/gallery.html?$RXP

Health Care up +89%: http://stockcharts.com/freecharts/gallery.html?XLV

Biotech up +112%: http://stockcharts.com/freecharts/gallery.html?$BTK

Hospitals up +126%: http://stockcharts.com/freecharts/gallery.html?$RXH

Welcome to the mixed-up government economy.

Based on past historical experiments with government intervention blowback, 0Care is likely to worsen our economy.

0Care takes productive funds out of our economy.

0Care puts them into yet another bloated government bureaucracy.

0Care is like the Federal Departments of Education and Energy. They produced no education or energy, just more bureaucratic expense, red tape and waste.

They actually reduced the supply of each product and raised prices, creating more debts in their place.

Student Loan debts of $981 billion now exceed auto loans and credit cards:

The US imports more energy with trade deficits than ever before.

As Harry Hazlitt wrote in Economics in One Lesson ~

"The art of economics consists in looking not merely at the immediate but at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups.":

http://en.wikipedia.org/wiki/Economics_in_One_Lesson

Politicians create emotional talking points that do not add up in our real world.

49 percent of doctors say they will stop accepting (lowball) Obamacare Medicaid payments. Many states do not like 0Care forcing Medicaid costs on them and are fighting it in court.

Politicians create emotional talking points that do not add up in our real world.

49 percent of doctors say they will stop accepting (lowball) Obamacare Medicaid payments. Many states do not like 0Care forcing Medicaid costs on them and are fighting it in court.

According to a survey from the Deloitte Center for Health Solutions of more than 600 doctors, six in 10 physicians said they expect many of their colleagues to retire earlier than planned in the next 1 to 3 years (when 0Care is fully implemented ).

Seventy-five percent believe the best and brightest may not consider a career in medicine.

83% of Doctors Considered Quitting Over Obamacare:

This is not good news when the USA faces an estimated doctor shortage of 90,000 by 2020.

Meantime, what of the $901 Billion 2013 scheduled deficit?

We say “scheduled,” because past experience proved actual budget deficits were consistently greater than government estimates.

Consider past Congressional Budget Office (CBO) and Office of Management and Budget (OMB) forecasts that overestimated tax revenues and underestimated government spending significantly.

Consider past Congressional Budget Office (CBO) and Office of Management and Budget (OMB) forecasts that overestimated tax revenues and underestimated government spending significantly.

Instead of a $901 Billion shortfall, the US Debt Clock shows a $1.02 Trillion US government budget so far in 2013, a +13% miss by the government budget forecast.

This $1.02 Trillion budget deficit adds to the $16.8 Trillion Federal Debt:

The $16.8 Trillion Federal Debt is 107% of the economy Gross Domestic Product (GDP), crowding out productive enterprise.

Small business formation is the lowest in generations due to government created economic conditions and red tape.

Small business formation is the lowest in generations due to government created economic conditions and red tape.

If/when manipulated interest rates return to historic levels, Federal debt service may go from fourth largest budget item to the largest budget item, crowding out Defense spending, Medicare/Medicaid, Social Security and everything else:

Unfunded Medicare, Prescription Drug and Social Security mandates were passed by present and past Congressional majorities, including the Freshman Las Vegas US Rep.

Thus current and future taxpayers face $124 Trillion in unfunded government liabilities that depend on either Fed fiat monetary inflation buying Treasury debt or taxpayers paying higher taxes because government did not police itself:

These government tax spending mandates basically reduce the American standard of living by the amount government borrows, regulates and spends.

They transfer money from productive members of society to unproductive members, including illegal aliens who come here with anchor babies for a free family ride they can't get at home.

The US Government actually advertised food stamps in Mexico without citizenship documents:

In 1994 we gave published testimony on Replacing the Income Tax to Bill Archer's House Ways and Means Committee:

Our Constitution Article I requires uniform taxes:

Section. 8.

The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States;

My conclusion in 1994 when I stood for office was that a modest flat universal 10% income tax on a postcard would simplify matters and increase productivity and revenues.

What we tax decreases and what we subsidize increases.

This is common sense.

Let's subsidize American prosperity by letting citizens keep more of what they produce.

What we tax decreases and what we subsidize increases.

This is common sense.

Let's subsidize American prosperity by letting citizens keep more of what they produce.

Hong Kong thrived for decades with a 16% modified flat tax:

A Constitutional uniform tax grows the economy.

The current jury-rigged special interest tax system contracts our economy on the backs of the middle class.

This benefits banks, foundations, mega-corporations and unions with their special interest lobbyists for the minority, buying special interest legislative favours, while paying lower or no taxes at all.

The current jury-rigged special interest tax system contracts our economy on the backs of the middle class.

This benefits banks, foundations, mega-corporations and unions with their special interest lobbyists for the minority, buying special interest legislative favours, while paying lower or no taxes at all.

Economists studying the American Jobs Creation Act found a return of 22,000% on lobbyists controlling legislation.

In other words, for each dollar spent on lobbyists, $220 in tax benefits were received:

In other words, for each dollar spent on lobbyists, $220 in tax benefits were received:

Russia proved the value of a lower flat tax with a lesson for the USA today.

Russia had a complicated tax scheme to fund unproductive wars in Afghanistan and Chechnya.

These led to mounting budget and trade deficits.

The Russian Ruble and Russian Economy collapsed with sovereign (government) debt defaults. These climaxed in the 1998 event known as The Russian Flu. This led to a Fed bailout for Long Term Capital Management hedge fund speculators in Russian Debt.

These led to mounting budget and trade deficits.

The Russian Ruble and Russian Economy collapsed with sovereign (government) debt defaults. These climaxed in the 1998 event known as The Russian Flu. This led to a Fed bailout for Long Term Capital Management hedge fund speculators in Russian Debt.

http://en.wikipedia.org/wiki/1998_Russian_financial_crisis

Chief Executive Officer (CEO) Jon Corzine's MF Global collapsed and took over a billion dollars of client assets and funds by speculating badly in European Debt. He is still walking around free after testifying under oath as he did not know where the money went. Maybe the former FBI Director Bankruptcy Trustee suing him does.

(As persuasive as Eric Holder saying he recused himself from domestic espionage on reporters, while signing the warrants, Hillary Clinton implying Benghazi did not matter after signing off denying them increased security, or various heads of the IRS refusing to resign or take responsibility for partisanship to re-elect the President by denying free speech to his opposition.)

Chief Executive Officer (CEO) Jon Corzine's MF Global collapsed and took over a billion dollars of client assets and funds by speculating badly in European Debt. He is still walking around free after testifying under oath as he did not know where the money went. Maybe the former FBI Director Bankruptcy Trustee suing him does.

(As persuasive as Eric Holder saying he recused himself from domestic espionage on reporters, while signing the warrants, Hillary Clinton implying Benghazi did not matter after signing off denying them increased security, or various heads of the IRS refusing to resign or take responsibility for partisanship to re-elect the President by denying free speech to his opposition.)

Russia passed a 13% flat income tax in 2001 for all citizens, with a 24% flat tax on corporations.

Russian corporations now pay over 73% of Russian Tax revenues, versus 12% in America.

Russia now has a booming economy with the third largest trade surplus in the world and an improving standard of living for all:

http://en.wikipedia.org/wiki/List_of_sovereign_states_by_current_account_balance

Not everyone knows Putin has a PhD in economic markets, (even if some claim his thesis was plagiarized) and reformed Russian military and police brutality (even if those opposing him were disappeared or jailed):

http://en.wikipedia.org/wiki/Vladimir_Putin

Not everyone knows Putin has a PhD in economic markets, (even if some claim his thesis was plagiarized) and reformed Russian military and police brutality (even if those opposing him were disappeared or jailed):

http://en.wikipedia.org/wiki/Vladimir_Putin

The last time the US had a trade surplus was 1975:

The last time the US had a budget surplus was 1957:

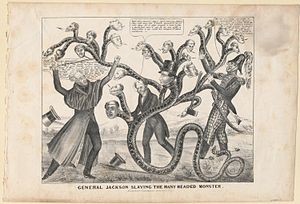

The last time the US paid off its debts was 1835, when Old Hickory Andrew Jackson was President and ended "the central bank hydra":

A cartoon depicts Jackson battling the many-headed monster of the bank.

A cartoon depicts Jackson battling the many-headed monster of the bank.

http://www.npr.org/blogs/money/2011/04/15/135423586/when-the-u-s-paid-off-the-entire-national-debt-and-why-it-didnt-last

Two Irish Presidents, John Fitzgerald Kennedy and Ronald Reagan, proved cutting tax rates increased tax revenues.

Two Irish Presidents, John Fitzgerald Kennedy and Ronald Reagan, proved cutting tax rates increased tax revenues.

Ironically, in more recent times a communist country provided proof of lower flat tax efficacy.

With the IRS Scandal, we have a strong incentive for genuine simpler tax reform in Washington DC and the USA, instead of rearranging the complex deck chairs on the USS Tax Titanic:

With the IRS Scandal, we have a strong incentive for genuine simpler tax reform in Washington DC and the USA, instead of rearranging the complex deck chairs on the USS Tax Titanic:

http://en.wikipedia.org/wiki/Tax_Code_of_Russia

China may also be communist, but they too understand trade surpluses create prosperity.

What's with DC?

China may also be communist, but they too understand trade surpluses create prosperity.

What's with DC?

Since my 1994 House Ways and Means Tax Publication, I came to understand Nobel Laureate James Tobin's financial transaction tax adapted by Wisconsin Economic Emeritus Professor Edgar Feige is even more economic, fair and productive than the 10% flat tax.

The APTT is an automated 28 basis point (.0028) transaction tax that also meets the Constitutional requirement of uniform taxes.

APTT saves money and time with a transparent transaction record.

APTT is a simple practical plan to replace our current complex system of federal and state income, sales, excise and estate taxes.

APTT is not rocket science.

APTT is just simple arithmetic that compounds economic growth:

APTT saves money and time with a transparent transaction record.

APTT is a simple practical plan to replace our current complex system of federal and state income, sales, excise and estate taxes.

APTT is not rocket science.

APTT is just simple arithmetic that compounds economic growth:

The financial transaction tax since 1694 is the oldest such tax in the world.

It has the benefit of fixing the casino economy, where little is produced except (rigged) speculation with a few big house winners and many retail customer losers.

It has the benefit of fixing the casino economy, where little is produced except (rigged) speculation with a few big house winners and many retail customer losers.

Mathematician, economist and successful fund manager John Maynard Keynes proposed a financial transaction tax in 1936 to end the Great Depression:

http://en.wikipedia.org/wiki/Financial_transaction_tax

Sadly, it was not passed, and led to another twenty plus years of depression and war.

Sadly, it was not passed, and led to another twenty plus years of depression and war.

APTT is so productive and simple it can eliminate and replace all other taxes.

To summarize replacing the income tax, we have a current tax system that is so compromised by special interests, big money and time consumed, it is counterproductive.

Estimates were made by the IRS National Taxpayer Advocate that 6 billion man-hours are consumed each year by the overcomplicated tax code, which still does not collect $600 B in taxes due:

http://www.taxpayeradvocate.irs.gov/2012AnnualReport

There is ample evidence the IRS was politicized. I know my tax problems first appeared when I ran for public office to reform Congress.

Estimates were made by the IRS National Taxpayer Advocate that 6 billion man-hours are consumed each year by the overcomplicated tax code, which still does not collect $600 B in taxes due:

http://www.taxpayeradvocate.irs.gov/2012AnnualReport

There is ample evidence the IRS was politicized. I know my tax problems first appeared when I ran for public office to reform Congress.

The income tax is like the earth-centered solar system that required greater and greater complex adjustments to compensate for eccentric orbits, until Copernicus repeated simpler ancient Greek claims that the solar system is sun-centered.

The present tax code is like clinging to the flat earth society when we know the earth is round.

The income tax code became another scandal like Nixon, where a partisan minority of the IRS apparently used arbitrary selective tax enforcement to intimidate and prevent free speech in the 2012 elections, benefiting political incumbents more than all Americans voting.

Let us thus take this opportunity to elect representatives for the majority of American citizens, not just the special interests.

Let us return our Congress, Courts and Executive Branch Congress supervises to Constitutional government of the people, by the people and for the people.

By doing so, we can replace the failed income tax system with a 10% flat tax on a postcard or a .0028 automatic transaction tax that can cut government bureaucratic waste to increase private sector jobs, productivity, prosperity and peace.

Constitutional government worked over 226 years to make America a land of freedom, peace and prosperity.

Seems like an easy smart decision and vote.

Next time we discuss Federal Reserve magic money and what it has done to our political economy.

Regards,

Richard Charles

http://usnvrepcan.blogspot.com/

We will not run unless we have the support of the majority of our constituents.

Click here to join our work for better government now:

Click here to join our work for better government now:

No comments:

Post a Comment